Medi Cal Income Limits 2025 Californian - MediCal Guidelines 2025 Shae Yasmin, Current asset limits are $130,000 for one person and $65,000 for each additional. Below are the income limits to qualify for the aged, blind and disabled program based on the federal poverty levels (fpl) amounts. California MediCal Limits (2025) California MediCal Help, Starting on january 1, 2025, assets, such as bank accounts, cash,. The asset limits were previously increased to.

MediCal Guidelines 2025 Shae Yasmin, Current asset limits are $130,000 for one person and $65,000 for each additional. Below are the income limits to qualify for the aged, blind and disabled program based on the federal poverty levels (fpl) amounts.

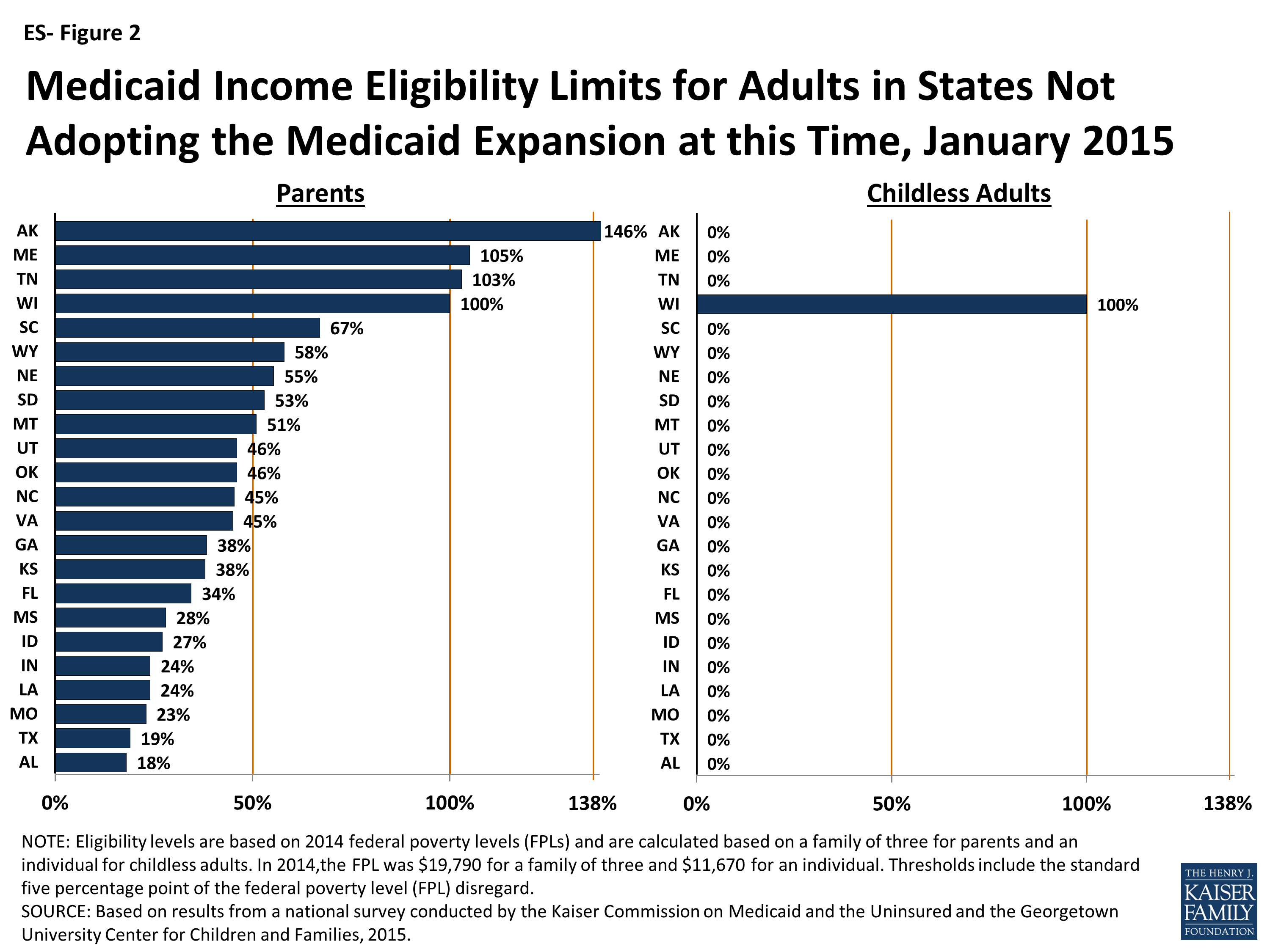

Medicaid Limits By State 2025 Elysia Atlante, The asset limits were previously increased to. Eligibility is based on several factors, including:

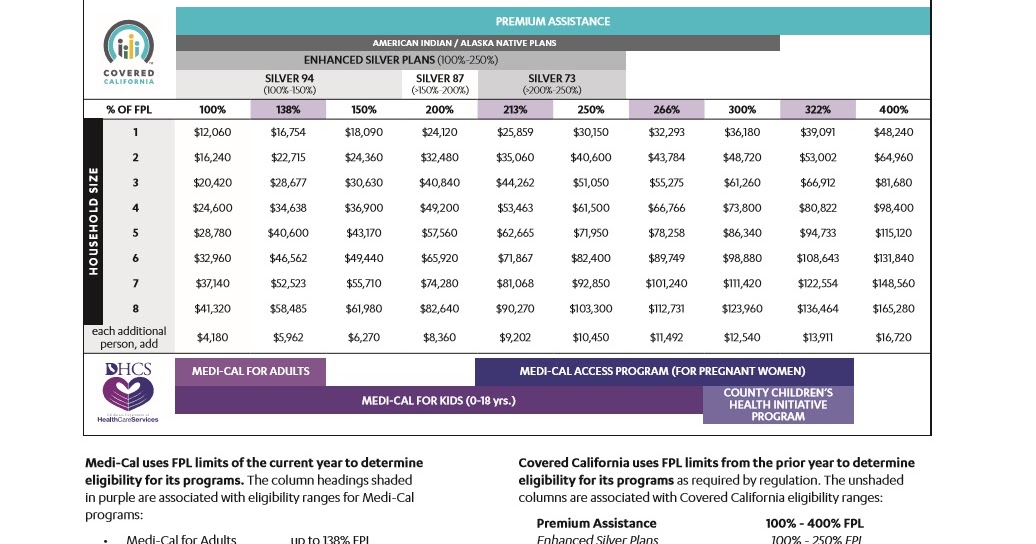

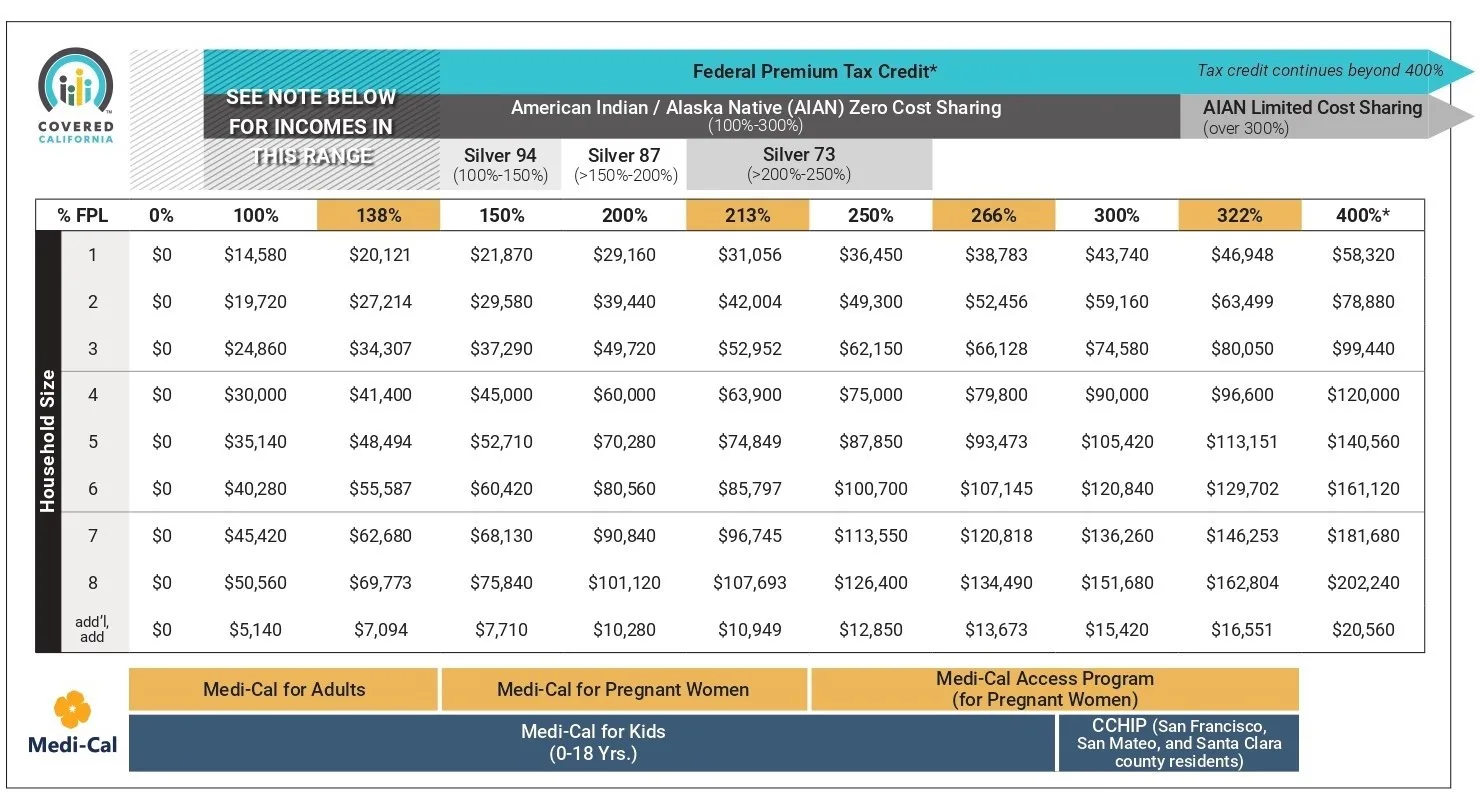

limits for MediCal and CoveredCa in California, About 15.3 million people, or almost 40% of the state’s population, are enrolled in medi. Below are the income limits to qualify for the aged, blind and disabled program based on the federal poverty levels (fpl) amounts.

MediCal Limits 2025 Family Of 3 Halli Kerstin, Meet calfresh’s income gross monthly income limits. This chart is anchored to the federal poverty level,.

For example, you would qualify for irmaa in 2025 if your magi from your 2025 tax returns meets the 2025 income thresholds ($103,000 for beneficiaries who file. Eligibility is based on several factors, including:

Your average tax rate is 10.94% and your marginal tax rate is 22%. The income limit fluctuates depending on household size;

Medi Cal Fee Schedule 2025 California Alana Augusta, About 15.3 million people, or almost 40% of the state’s population, are enrolled in medi. Your average tax rate is 10.94% and your marginal tax rate is 22%.

Covered California Limits Chart, Current asset limits are $130,000 for one person and $65,000 for each additional. Your average tax rate is 10.94% and your marginal tax rate is 22%.

Current asset limits are $130,000 for one person and $65,000 for each additional.

MediCal Limits 2025 For Seniors Age Lucie Stepha, This chart is anchored to the federal poverty level,. The 2025 federal poverty level for income.

2025 medical amounts modest increase fpl, that’s $ 20,124 for an individual or.

MediCal Guidelines 2025 Shae Yasmin, Usually, if you’re eligible for the programs above, you meet certain income requirements. Benefits programs typically require you to.